The 2-step acquisition effectively saves MV Agusta from certain failure. But the road is still uphill!

The news is already in the title so all that remains is to go to the reasons and details, starting with a photograph of the recent corporate situation of MV Agusta, a glorious brand but full of problems that risk compromising its future. In fact, that of KTM is, for the Varese-based company, the last chance. A lifesaving move.

How did we get there?

Founded in ’45 (11 years after KTM) and with glorious vicissitudes, in recent years it is a company that has struggled, practically gasped. The world titles are just a memory and what the company is paying for is still the second crisis of 2004-2016.

First key moment

In 2008 the senseless purchase by Harley-Davidson of the MV Agusta Group INCLUDING THE CAGIVA BRAND (you will find out the reason for the capital) for 70 million i save the company then resold a year later for 1 euro after a 40 million investment of Harley and the birth of the F3.

Why 1 euro? Because Harley Davidson still owes some money and prefers a quick and painless exit, thus agreeing, also by virtue of the difficult financial situation of those years.

The Germans arrive

Too rapid growth, bad financial management, increased debt, non-existent sales network and lack of spare parts bring the company into the arms of Mercedes-AMG in 2014.

But the Germans are wrong. They buy only 25% of MV Agusta for 25 million euros and, at the beginning of 2016, try to sell non-essential assets with debts of over 40 million by dropping their shares below 20%.

This allows banks to demand repayment of the debt. Bad.

Suppliers begin to refuse the shipment of components and spare parts and MV Agusta seeks first help in court.

Added to this is the flooding of Lake Varese with flooding of the plants and the company is asking for 15 million in funding for (this is the official reason) to recover and expand its range of action abroad, in particular the United States, South America and Asia.

In March 2016, the Varese Court approved the “Agreement of continuity” protection act with some constraints: reducing production from 9,000 motorcycles per year to 6,000-7,000 , reducing research and development costs by 15 million euros to 7 million and finally reduce the expenses for the “Reparto Corse” (racing department) from 4 million euros to 600,000.

There are also layoffs of around 200 employees and threats from suppliers who do not deliver the materials to build the bikes and assist customers. MV gasps until 2017 when Mercedes AMG leaves without having done anything.

The Russians are coming!

It is time for the Russians, who together with Giovanni Castiglioni’s MV Holding buy 25% of MV from the Germans and declare that they are back in profit.

The new company puts in 40 million by launching new products and restructuring (perhaps) the sales network, a historic weak point of MV.

The capital increase is carried out by GC Holding , the company of Giovanni Castiglioni, and by ComSar Invest SA , the Luxembourg investment fund of the Anglo-Russian group Black Ocean of Rashid Sardarov , who works as an oil tanker and has a fortune of 4 billions of dollars.

The company is entrusted to Sardarov’s sons, Timur in particular becomes CEO , with Giovanni Castiglioni at his side.

It will never be a peaceful relationship and there is eternal conflict.

An example is the Lucky Explorer Project , a motorcycle heir to the Cagiva Elephant which, however, does not carry the Cagiva brand due to a dispute between the Russians (who believe they have acquired the brand as Harley Davidson and Mercedes did) and Castiglioni who instead claims it for if not included in the acquisition agreement. It’s just the tip of the iceberg of internal malaise.

The present

The agreement with KTM AG, a subsidiary of Pierer Mobility , which is in charge of distributing the Varese motorcycles in Canada, the United States and Mexico, arrives in September 2022 .

It is a simple distribution agreement but the orange Pac Man , which enters companies as a distributor and then eats them as in the video game, is finally interested in acquiring the majority of MV Agusta by 2023 and 100% by 2024.

A few things to fix

A long-standing arrangement with creditors (2016), a due diligence to be carried out and a verification of the “business mess”, make things feasible but complex.

In fact, there is a chronic delay in payments to suppliers and spare parts dealers (who work poorly and compromise the production capacity and reliability of the motorcycles), a tug-of-war on various issues between the Russians and Castiglioni and an assessment of the real industrial capacity of the company, elements necessary to quantify the acquisition.

The idea is to clean up the company organization charts and the management, (full of friends of friends with a purchasing campaign made up of superstar managers who do not “perform”), restore credibility to the product (which is excellent even if spoiled by relationships with suppliers) and reorganize the marketing and sales network.

According to some rumors , the production would remain in Italy while the whole management aspect would move to Austria.

Other voices speak instead of an interest of local authorities to purchase the facilities on the lake to convert them for tourism purposes.

After all Husqvarna , which would belong to the same industrial family, seems to have space in Cassinetta di Biandronno and money would be handy.

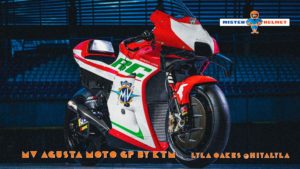

For KTM, a renowned leader in off-roading, extremely powerful in small motorcycles (in Asia together with CF Moto ) and strong with a highly organized sales network, a road and track sports brand of real and indisputable prestige would finally arrive. Other than Gas Gas! An MV Agusta MotoGP would be truly credible and sensible and would also appeal to Dorna.

And so what looks like an “Anschluss” , a painful German annexation of an impotent competitor, is ultimately a good move for everyone.

The alternative, with the current situation, is to fail for real, once and for all. We’ve seen far too many glorious brands in lawyers’ drawers.

No comment yet, add your voice below!